Where Land Costs are Highest

Understanding the Housing Cost Market

In the United States, home prices are significantly influenced by the value of the land beneath them.

In the United States, home prices are significantly influenced by the value of the land beneath them. In several major metropolitan areas, land constitutes a substantial portion of property values, often exceeding 60%. This high land share correlates with affordability challenges, as elevated property costs make homeownership increasingly out of reach for many residents.

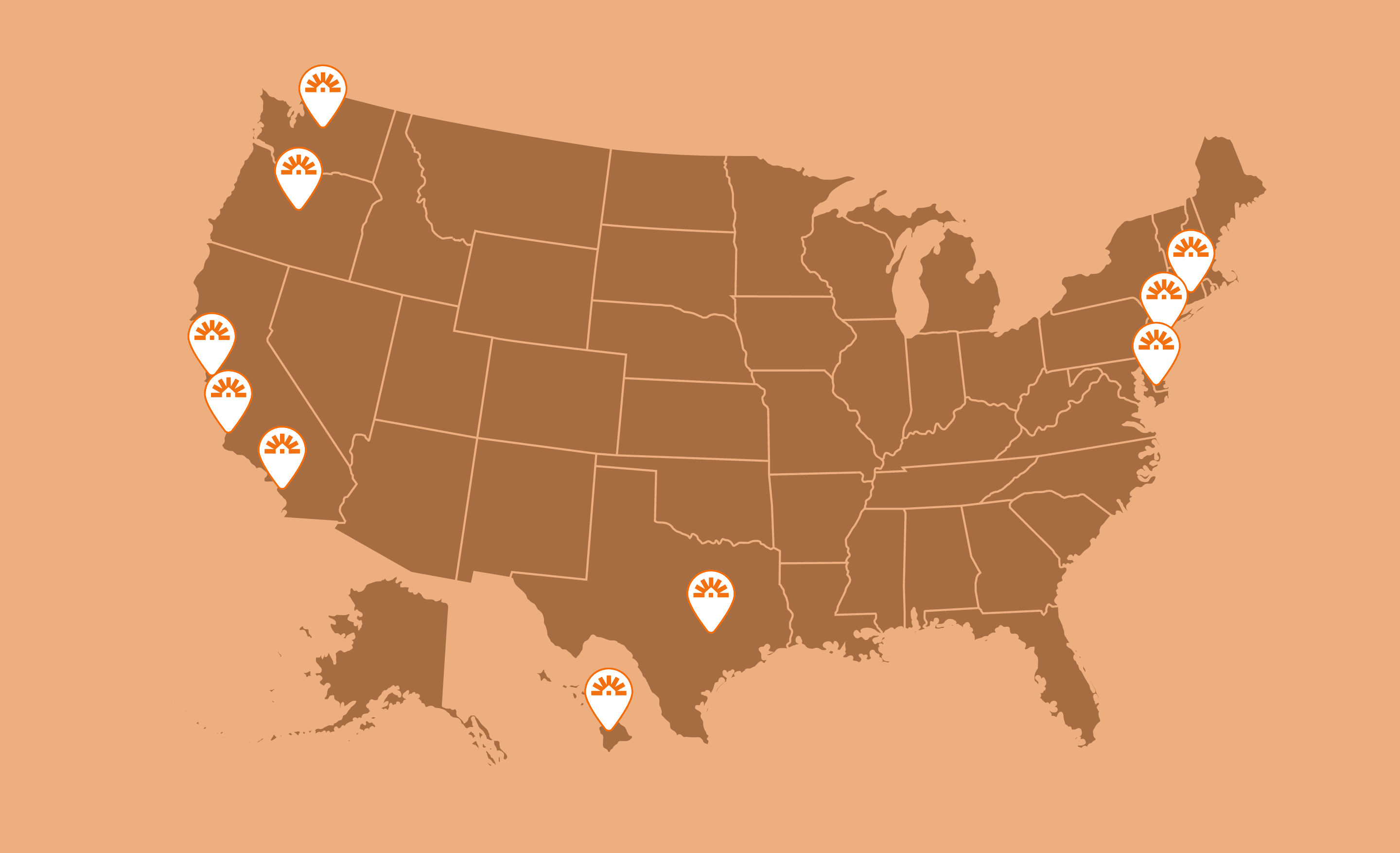

Below, we examine eight prominent U.S. metro areas known for their high land values. For each, we provide the median single-family home value, the estimated land share percentage, and the home price-to-income ratio, highlighting the affordability pressures facing residents.

EXAMPLE 1:

New York-Newark-Jersey City, NY-NJ-PA

- Population: Approximately 19.5 million

- Median Single-Family Home Value: Around $677,000

- Land Share of Home Value: Among the highest in the U.S., often exceeding 60%

- Home Price-to-Income Ratio: ~9.8:1

New York City’s high density and stringent zoning laws contribute to high land values, making homeownership a challenge for many residents. Despite a slight cooling in prices in 2023, affordability remains a persistent issue.

EXAMPLE 2:

San Francisco-Oakland-Berkeley, CA

- Population: Approximately 4.6 million

- Median Single-Family Home Value: Around $1.2 million

- Land Share of Home Value: Among the highest in the U.S., often exceeding 70%

- Home Price-to-Income Ratio: ~14:1 (one of the highest in the U.S.)

San Francisco's limited land availability and stringent zoning regulations contribute to its high land values, making homeownership less accessible for many residents. Despite a slight decline (~4%) in home prices in 2023, San Francisco remains one of the least affordable cities in the country.

EXAMPLE 3:

San Diego-Chula Vista-Carlsbad, CA

- Population: Approximately 3.3 million

- Median Single-Family Home Value: Approximately $945,000

- Land Share of Home Value: Estimated between 65-75%

- Home Price-to-Income Ratio: ~12:1

San Diego’s desirable coastal location and limited developable land drive up property values, making it one of the most unaffordable metro areas in the U.S. While home prices dipped slightly in late 2023, demand remains strong.

EXAMPLE 4:

San Jose-Sunnyvale-Santa Clara, CA

- Population: Approximately 1.8 million

- Median Single-Family Home Value: Around $1.6 million

- Land Share of Home Value: Approximately 70%

- Home Price-to-Income Ratio: ~13:1

San Jose, at the heart of Silicon Valley, is one of the most expensive housing markets in the U.S. The tech-driven economy leads to high demand, with limited land availability pushing home prices to extreme levels.

EXAMPLE 5:

Honolulu, HI

- Population: Approximately 853,000

- Median Single-Family Home Value: Around $999,000

- Land Share of Home Value: Estimated between 60-70%

- Home Price-to-Income Ratio: ~10:1

Honolulu’s island geography limits land availability, driving up property values. The limited housing supply and high demand contribute to one of the highest home price-to-income ratios in the country.

EXAMPLE 6:

Boston-Cambridge-Newton, MA-NH

- Population: Approximately 4.9 million

- Median Single-Family Home Value: Around $740,000

- Land Share of Home Value: Approximately 60%

- Home Price-to-Income Ratio: ~9.5:1

Boston’s historical significance and limited land for development contribute to high property values. Despite rising mortgage rates, home prices continued to grow (~2-3%) in 2023 due to strong demand.

EXAMPLE 7:

Austin-Round Rock-Georgetown, TX

- Population: Approximately 2.4 million

- Median Single-Family Home Value: Around $483,000

- Land Share of Home Value: Between 45-55%

- Home Price-to-Income Ratio: ~6.8:1

Austin experienced a huge housing boom in the 2020s, with home prices skyrocketing over 50% in just three years. While prices dropped ~10% in 2023, affordability remains a challenge for middle-income buyers.

EXAMPLE 8:

Seattle-Tacoma-Bellevue, WA

- Population: Approximately 4.1 million

- Median Single-Family Home Value: Around $795,000

- Land Share of Home Value: Between 55-60%

- Home Price-to-Income Ratio: ~8.3:1

Seattle’s booming tech industry and geographic constraints contribute to high property values. Prices declined ~3% in 2023, but the market remains tight, with limited supply keeping costs high.

Addressing the Housing Crisis

The affordability crisis in these metros is driven largely by high land values, restrictive zoning, and housing supply constraints. Without significant reforms, affordability will continue to decline, leaving many households priced out of homeownership.

The Need for Housing Reform

To make housing more affordable, policymakers can:

- Reform zoning laws to allow for higher-density developments.

- Reduce regulatory barriers that slow down housing construction.

- Expand incentives for developers to build more affordable housing.

Innovative Affordability Solutions

In addition to policy reforms that can increase our housing supply, solutions like Jubilee offer a new pathway to homeownership by purchasing the land, so you don't have to. You buy the home and lease the land from them, and have the flexibility to buy out the land at any time. This allows you to enter the housing market with a smaller down payment and lower monthly costs, while still having the flexibility of traditional homeownership.

By implementing these changes and supporting innovative solutions, we can work towards making homeownership more accessible—even in the most expensive and land-constrained cities.

More resources from Jubilee

Can You Build Equity with a Ground Lease?

Yes, you can build equity with a ground lease.

A Real Estate Agent’s Guide to Jubilee

If you’re an agent working in a high-cost market, you know how tough it’s become for both sides of the transaction.

Testing on jubilee

At Jubilee, the name is more than just a word – it embodies our core mission and values. We chose "Jubilee" for two key reasons: to celebrate the joy of homeownership and to reflect our commitment to solving long-term inequity in housing.